Why LIC is better than other insurers?

Before we start busting some myths, let us look at the strength of LIC against the combined force of 23 private insurance companies and why is LIC is better than other insurers.

LIC had a monopoly in Indian market until the year 2000. After 2000 FDI in insurance sector was allowed. Many foreign companies tied up with Indian companies to offer insurance. India being a vast country, the insurance penetration is not more than 3.7% of the GDP. Seeing a huge opportunity many companies set up shop in India after 2000. Breaking the monopoly of LIC was a huge task for these companies.

Private insurers brought many diverse plans into the market to beat the competition of LIC. We have also seen a recent trend where people are more inclined towards investing in term insurance than traditional insurance plans. Awareness creation for public is a good thing. Same time the private insurers have increased their market share between 25 to 30% within 20 years. It is obvious that the private insurers have not achieved this market share by selling only term insurance. Various products they offer like endowment plans, moneyback plans, children plans and ULIPS are very similar to the plans available with LIC. Painting traditional LIC plans as not a good option for investment/insurance is just a marketing strategy by these companies.

It is totally encouraging that 75% of Indians still think that Life Insurance Corporation of India is the most reliable life insurance company in the country. LIC has come up with many new plans to keep with the trend. The insurer caters to the needs of the millennials. We can choose from short term plans, ULIPS and many more

How to choose between LIC and private insurers?

Compare : Since data is widely available, you can check the credibility of the company.

1. Solvency ratio (A solvency ratio measures the extent to which assets cover commitments for future payments, the liabilities i.e the size of the capital).

2. Claim settlement ratio (LIC has been consistent with 98% and above settling) 3. Past records

4. Services offered by the company.

5. The terms and conditions (read policy bond and fine prints)

6. Accessibility across the country.

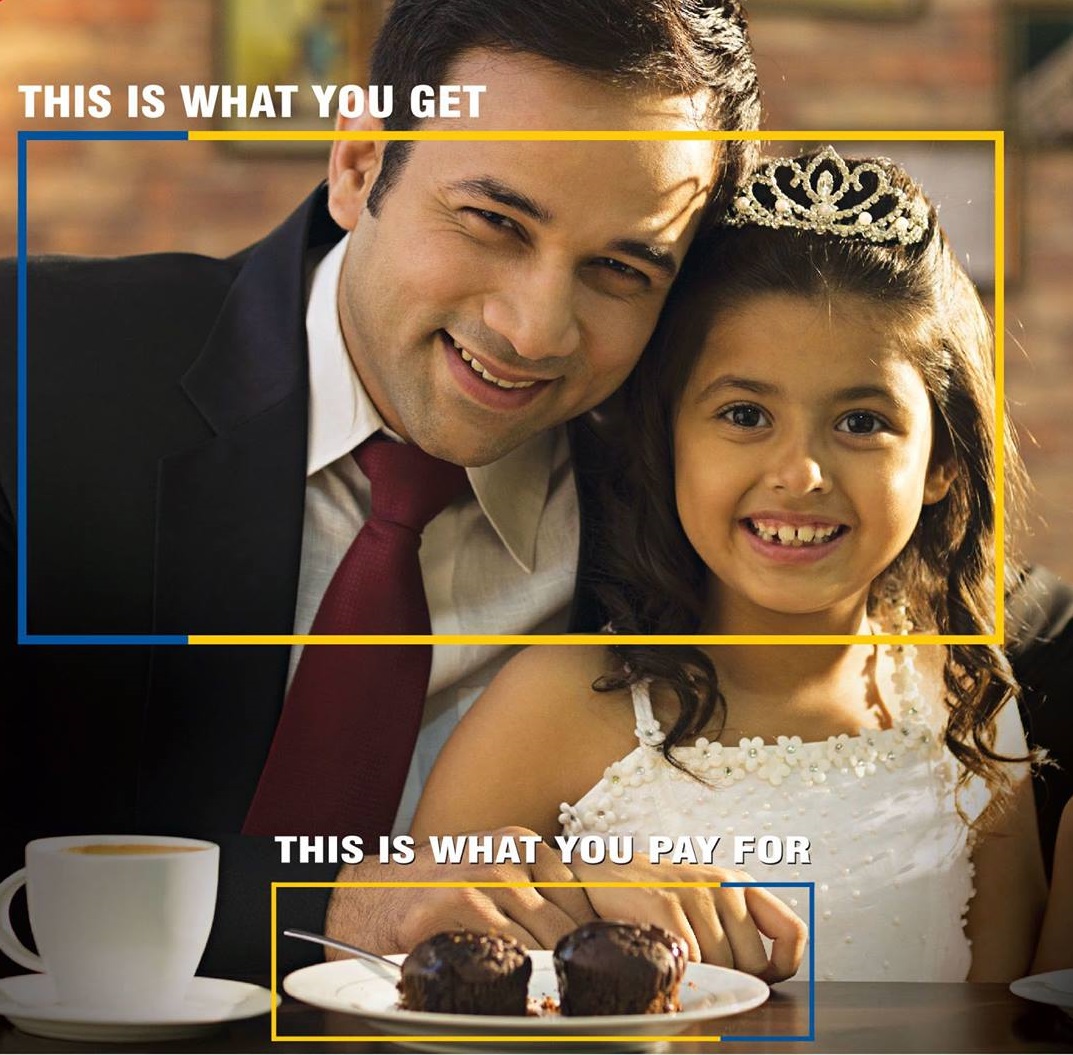

We have to look at a product which satisfies our needs and can bring relief to our loved ones in our absence.

Innovation : LIC has been adapting to many technological changes to keep with the trend of digital India. The policy servicing, premium payments, loan repayments, maturity claims are all updated digitally. They can be done from any where within the country. Policy buying process has also now been made easy with ANANDA.

Sales channel: Traditionally agents have been the driving force of LIC. Recently the insurer has made a switch to online selling, direct channel, IMF and POS.

LIC is said to be the largest life insurance company in the world with 23 crore customers and counting. It offers some of the most reasonably rated premiums and adequate coverage options, regardless of which walk of life an individual belongs to. So make your decision wisely.

Check out our products from below links: