LIC BIMA Diamond Plan Benefit

LIC BIMA DIAMOND MONEY BACK – LIC of India Launching the “Bima Diamond plan” on the occasion of the 60th year/Diamond Jubilee celebrations of LIC, Sept 1, 2016, LIC Bima Diamond 4 year money back plan is a Non-linked, with loyalty addition,limited premium payment plan.

This plan is provides money back at an interval of every 4th year. LIC’s Bima Diamond provided extended life cover up to the half of the policy term after the completion of the policy term. This policy is available for sale up to 31 August 2017 only.

LIC BIMA Diamond Plan Features

It’s thrice as nice, With Triple Advantage

- Money Back –16,20,or 24 years term money back plan with tax free returns every 4 Years.

- Extended Life Cover after completion of the term 50% of the Sum Assured for 8.10,or 12 years respective of the term.

- 2 years auto cover after payment of 5 years premium.

- On maturity,Sum Assured less the survival benefit + Loyalty Addition (as applicable) will be paid.

- Optional Add-ons Accidental Death and Disability Benefit and Term riders are available.

- Income Tax benefit under section 80-C of income Tax Act, 1961

- Maturity amount is tax free under Section 10(10)(d).

BIMA DIAMOND plan Eligibilities

Minimum age at Entry – 14 years (Completed).

Maximum age at Entry

| Term of the Policy | Maximum age at Entry | |

| 16 | Max. age is 50 yrs. | |

| 20 | Max. age is 45 yrs. | |

| 24 | Max. age is 41 yrs. |

| Policy Term | 16, 20, 24 yrs.. |

| Premium Payment Term | 10, 12, 15 yrs. |

| Min. Sum Assured | Rs.100,000. |

| Max. Sum Assured | Rs.500,000. |

| Premium payment mode | SSS, ECS, Quarterly, Half Yearly and Yearly. |

| Max. Accident Death Benefit | 5 LACS. |

Benefits of LIC Bima Diamond money back plan

Death Benefits

In case of the death of Life Assured before the date of Maturity

During the first 5 policy years “Sum Assured on Death” will be paid to the nominee.

After completion of 5 policy years but before the date of maturity: “Sum Assured on Death + Loyalty addition (if any) will be paid to the nominee.

The death benefit will not be less than the 105% of all the premium paid in the policy as at the date of death of the life assured.

In case of the death of Life Assured during the extended cover period

An amount equal to 50% of Basic sum assured will be paid to the nominee.

Survival Benefits in LIC Bima Diamond money back plan

If policy holder survives to the specified duration during the policy term, then a fixed percentage of Basic Sum Assured is will be payable to the life assured. The fixed percentage in various terms are mentioned below:

| LIC BIMA DIAMOND SURVIVAL BENEFITS | POLICY YEAR AND MONEY BACK(as % of basic sum assured) | |

| POLICY TERM | ||

| 4TH YEAR 8TH YEAR 12 TH YEAR | 16TH YR. 20 YR. | |

| 16 | 15 % 15 % 15 % | NA NA |

| 20 | 15 % 15 % 15 % 15% NA |

| 24 | 12 % 12 % 12 % 12% 12% |

Disability Benefit Rider

In LIC Bima Diamond plan 841 If policy holder permanent disable arising due to accident. Accident Benefit Sum Assured will be paid in equal monthly installments spread over 10 years and future premiums under this policy, shall be waived. An amount will paid within 6th month from the date of accident.

Maturity Benefits

If the Policy holder survives till the end of the policy term, “Sum Assured on Maturity” along with Loyalty Addition, if any will be payable to the Life Assured. Where “Sum Assured on Maturity” under LIC Bima Diamond Plan is 55% of Basic Sum Assured in case if policy term is 16 years and 40% of Basic Sum Assured under Policy tenures of 20 and 24 years.

Income Tax Benefit

Income Tax Benefits available under Section 80-C & Maturity Benefit under section 10(10)D.

Benefit Example for LIC BIMA DIAMOND Money Back Policy

An example of KAPIL who is purchasing this Plan with following details.

Sum Assured: Rs.5,00,000

Policy Term: 24 Years

Premium Payment term: 15 Years

Policy Purchase Year: 2016

Age: 30 Years

Yearly Premium: Rs. 30536

Maturity Details

If policy holder KAPIL survives the policy term 20 years then Maturity will be as under.

| Maturity Year | Maturity Age | Maturity Amount(approx) |

| 2040 | 54 | 425000 excluding money back |

If he survives,

At end of 4th year he get 60,000 /-

At end of 8th year he get 60,000 /-

At end of 12th year he get 60,000 /-

At end of 16th year he get 60,000 /-

At end of 20th year he get 60,000 /-

At Maturity age i.e., he get 2,00,000 +Loyalty Addition(if applicable).

Year-wise Death Claim given as under

| YEAR | AGE | RISK NORMAL | RISK ACCD | PREMIUM | TAX SAVED | NET PREM | AMOUNT RECEIVED |

| 2016 | 30 | 500000 | 1000000 | 30536 | 8830 | 21706 | 0 |

| 2017 | 31 | 500000 | 1000000 | 29984 | 8830 | 21154 | 0 |

| 2018 | 32 | 500000 | 1000000 | 29984 | 8830 | 21154 | 0 |

| 2019 | 33 | 500000 | 1000000 | 29984 | 8830 | 21154 | 0 |

| 2020 | 34 | 500000 | 1000000 | 29984 | 8830 | 21154 | 60000 |

| 2021 | 35 | 725000 | 1225000 | 29984 | 8830 | 21154 | 0 |

| 2022 | 36 | 725000 | 1225000 | 29984 | 8830 | 21154 | 0 |

| 2023 | 37 | 725000 | 1225000 | 29984 | 8830 | 21154 | 0 |

| 2024 | 38 | 725000 | 1225000 | 29984 | 8830 | 21154 | 60000 |

| 2025 | 39 | 725000 | 1225000 | 29984 | 8830 | 21154 | 0 |

| 2026 | 40 | 725000 | 1225000 | 29984 | 8830 | 21154 | 0 |

| 2027 | 41 | 725000 | 1225000 | 29984 | 8830 | 21154 | 0 |

| 2028 | 42 | 725000 | 1225000 | 29984 | 8830 | 21154 | 60000 |

| 2029 | 43 | 725000 | 1225000 | 29984 | 8830 | 21154 | 0 |

| 2030 | 44 | 725000 | 1225000 | 29984 | 8830 | 21154 | 0 |

| 2031 | 45 | 725000 | 1225000 | 0 | 0 | 0 | 0 |

| 2032 | 46 | 725000 | 1225000 | 0 | 0 | 0 | 60000 |

| 2033 | 47 | 725000 | 1225000 | 0 | 0 | 0 | 0 |

| 2034 | 48 | 725000 | 1225000 | 0 | 0 | 0 | 0 |

| 2035 | 49 | 725000 | 1225000 | 0 | 0 | 0 | 0 |

| 2036 | 50 | 725000 | 1225000 | 0 | 0 | 0 | 60000 |

| 2037 | 51 | 725000 | 1225000 | 0 | 0 | 0 | 0 |

| 2038 | 52 | 725000 | 1225000 | 0 | 0 | 0 | 0 |

| 2039 | 53 | 725000 | 1225000 | 0 | 0 | 0 | 0 |

| 2040 | 54 | 250000 | 250000 | 0 | 0 | 0 | 425000 |

| 2041 | 55 | 250000 | 250000 | 0 | 0 | 0 | 0 |

| 2042 | 56 | 250000 | 250000 | 0 | 0 | 0 | 0 |

| 2043 | 57 | 250000 | 250000 | 0 | 0 | 0 | 0 |

| 2044 | 58 | 250000 | 250000 | 0 | 0 | 0 | 0 |

| 2045 | 59 | 250000 | 250000 | 0 | 0 | 0 | 0 |

| 2046 | 60 | 250000 | 250000 | 0 | 0 | 0 | 0 |

| 2047 | 61 | 250000 | 250000 | 0 | 0 | 0 | 0 |

| 2048 | 62 | 250000 | 250000 | 0 | 0 | 0 | 0 |

| 2049 | 63 | 250000 | 250000 | 0 | 0 | 0 | 0 |

| 2050 | 64 | 250000 | 250000 | 0 | 0 | 0 | 0 |

| 2051 | 65 | 250000 | 250000 | 0 | 0 | 0 | 0 |

Additional Information about LIC BIMA DIAMOND Money Back Policy

Risk Coverage: –End of Term of the Policy.

Date of Commencement of Risk: Risk commencement starts when taking the policy(day one).

Locking period: – 3 years.

Loan Facility: – Available.

Income Tax Reduction: Available under Section 80-C and Section 10 (10D) for Maturity returns.

Loan: Available.

Riders available: Yes.

Policy Revival: Policy can be revived before 2 years from date of First Unpaid Premium (FUP).

Suicide Clause: if the policy holder commit suicide before 1 year he will be returned back 80% of premium what he paid.

Proposal Forms: Proposal Form no. 300 or 340 will be used under this plan.

Cooling-off Period: If a policyholder is not satisfied with the ‘Terms and Conditions” of the policy, he/she may return the policy within 15 days from the date of receipt of the policy.

Services that I offer

- New LIC Policy Quotes and Completion

- Complete guidance

- Doorstep Premium Collection Service

- Personalized Policy Recommendations

- Renewal / Revival of Lapsed Policies

- Human Life Value Calculation

- LIFE TIME SERVICES

Office Address:-25,KG,Marg,Jeevan Prakash Building.

LIC of India,Branch Unit-117.

3rd floor,C.P. New Delhi-110001.

OTHERS MONEY BACK PLANS

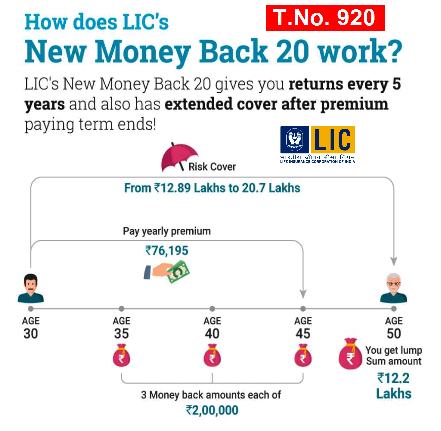

LIC New Money Back Plan – 20 years

LIC New Money Back Plan 25 Years